Payment Fraud Prevention

In today’s digital landscape payment fraud has become a major concern for businesses and individuals alike. As cybercriminals continuously evolve their tactics, organizations need robust and proactive solutions to prevent payment fraud and safeguard their financial transactions.

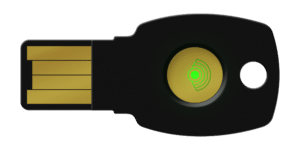

FEITIAN offers advanced cybersecurity solutions tailored specifically for payment fraud prevention, such as secure authentication and encryption technologies.

Payment Fraud Protection Tactics

Multi-Factor Authentication (MFA)

Tokenization

Encryption and Secure Communication

Payment Fraud Threats

Credit Card Fraud

Phishing Scams

Account Takeover

Suggested products

Benefits of Preventing Payment Fraud

Financial Loss Prevention

Regulatory Compliance

Preventing payment fraud ensures compliance with industry regulations and standards, such as the Payment Card Industry Data Security Standard (PCI DSS), reducing the risk of penalties and legal consequences.

Improved Customer Experience

Customer Trust and Reputation

Enhanced Operational Efficiency

Business Continuity

Relevant Posts

Unlock the Future: FEITIAN Products and Google’s New Passkey Feature

FEITIAN MFA Cryptographic Module has achieved the FIPS 140-2 level 2

Use FEITIAN FIDO security key to protect your Apple ID

Questions? Contact Sales

We understand that finding the right security solutions for your business is crucial, and our dedicated sales team is here to assist you every step of the way. By filling out our sales support form, you can connect with our knowledgeable sales representatives who will guide you through the process, answer your questions, and provide tailored recommendations based on your unique requirements.

Contact information:

408-352-5553

2580 N First St. Suite 130, San Jose, CA 95131

sales@ftsafe.us

"*" indicates required fields