Cyber Security for Financial Institutions

In an increasingly digital financial landscape, the security of financial institutions is essential. With the rise of sophisticated cyber threats targeting sensitive financial data and transactions, the need for robust cybersecurity measures is undeniable. FEITIAN understands the unique cybersecurity challenges faced by financial institutions and offers comprehensive solutions to protect against cyber attacks, fraud, and data breaches.

Financial Institution Authentication Use Cases

User Login Security

Transaction Verification

Regulatory Compliance

Cyber Security Threats in Financial Institutions

Data breaches

Distributed Denial-of-Service (DDoS) attacks

Phishing attacks

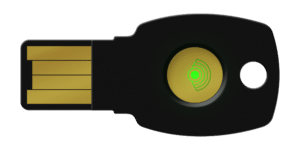

Suggested products

Financial Institution Cyber Security Benefits

Data protection

Regulatory compliance

Trust and customer confidence

Fraud prevention

Business continuity

Competitive advantage

Robust cyber security measures can give financial companies a competitive edge, as customers and partners are increasingly concerned about the protection of their financial information.

Relevant Posts

Unlock the Future: FEITIAN Products and Google’s New Passkey Feature

FEITIAN MFA Cryptographic Module has achieved the FIPS 140-2 level 2

Use FEITIAN FIDO security key to protect your Apple ID

Questions? Contact Sales

We understand that finding the right security solutions for your business is crucial, and our dedicated sales team is here to assist you every step of the way. By filling out our sales support form, you can connect with our knowledgeable sales representatives who will guide you through the process, answer your questions, and provide tailored recommendations based on your unique requirements.

Contact information:

408-352-5553

2580 N First St. Suite 130, San Jose, CA 95131

sales@ftsafe.us

"*" indicates required fields